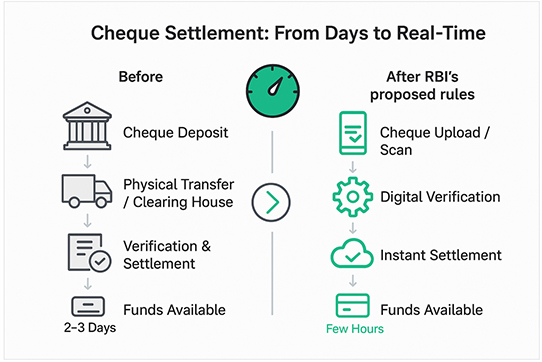

The RBI, Reserve Bank of India, has proposed guidelines to reduce cheque settlement time from 2-3 working days to a few hours. This move will bring cheque transactions close to the NEFT and RTGS processing speeds. This also means that all the traditional methods of processing cheques would be rendered useless or put under significant strain.

Overview of the RBI’s New Guidelines

Effective October 2025, cheque processing will move from a batch-based cycle (often taking up to 2-3 working days) to a continuous, near-real-time clearance framework. This initiative, termed “Continuous Clearing and Settlement”, is being rolled out in two phases.

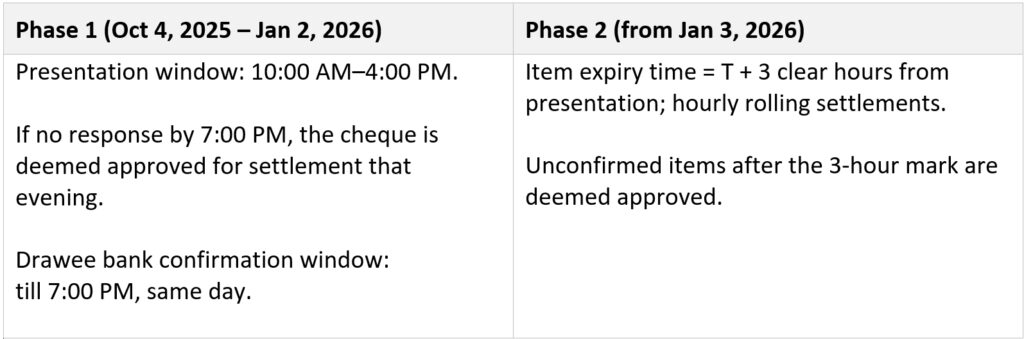

Phase 1 (Effective Oct 4, 2025)

Banks must scan each cheque upon receipt and send the image and MICR data to the clearing house immediately, rather than waiting for end-of-day batches. Drawee banks (the banks on which cheques are drawn) then have until 7:00 PM (end of the confirmation session) to confirm the status of each cheque – either positive confirmation (honour) or negative (dishonour).

Phase 2 (Effective Jan 3, 2026)

The clearing cycle becomes even tighter. Cheques must be cleared within ~3 hours of presentation. For example, a cheque presented between 10:00–11:00 AM must be confirmed by 2:00 PM the same day. In Phase 2, rolling settlements will occur every hour based on incoming confirmations.

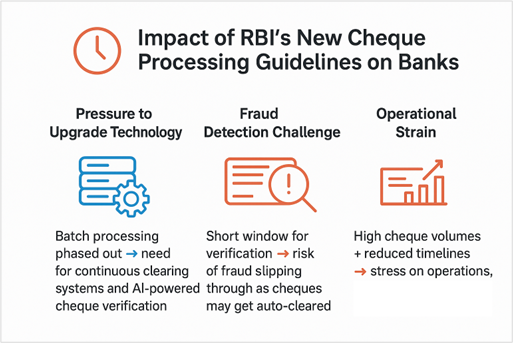

How do the RBI Guidelines Impact Banks?

These guidelines clearly indicate that banks must upgrade their current systems and processes in preparation.

Pressure to Upgrade Technology and Process

Guidelines dictate that end-of-day batch processing be phased out. To adhere to this, banks will need to build infrastructure that supports a continuous clearing framework. This may require banks to adopt AI-powered cheque processing solutions that can read and vet cheques, reducing human intervention.

Inability to Catch Fraud in a Short Processing Window

The timelines to settle cheques are short, where failing to confirm a cheque means it will be automatically cleared by default. Not only does the short window strain the system, but if the cheques are automatically settled, the drawee bank has little or no time to identify fraud.

Crumbling Operations and Human Workforce Under the Cheque Volume

On average, a large bank may receive more than a lakh of cheques every day. Already, the operations are under strain, and the situation gets more complicated with a shorter settlement window.

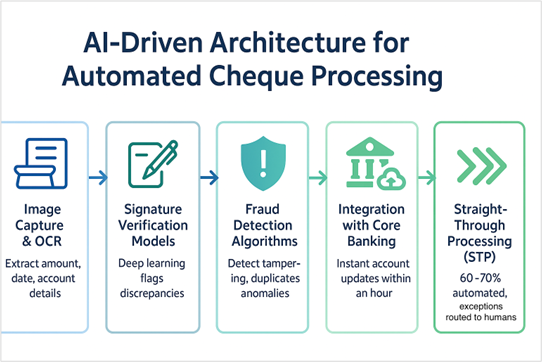

How to Automate Cheque Processing – Building an AI-Driven Architecture?

Automation in cheque processing is not a single tool but an end-to-end architecture that connects front-end capture, intelligent validation, fraud detection, and core banking integration. Here’s what it entails:

- Image Capture & OCR: High-speed scanners + Optical Character Recognition to extract amount, date, and account details.

- Signature Verification Models: Deep learning models trained on specimen signatures to flag discrepancies.

- Fraud Detection Algorithms: Machine vision to spot tampering, duplicate presentation, and unusual cheque patterns.

- Integration with Core Banking: Real-time updates to customer accounts within an hour of settlement.

- Straight-Through Processing (STP): Automating 60–70% of cheques end-to-end, with exceptions escalated to humans.

AI flips the script – instead of looking backward (in the manner of traditional cash flow forecasting), it predicts what’s ahead using real-time data and deep learning.

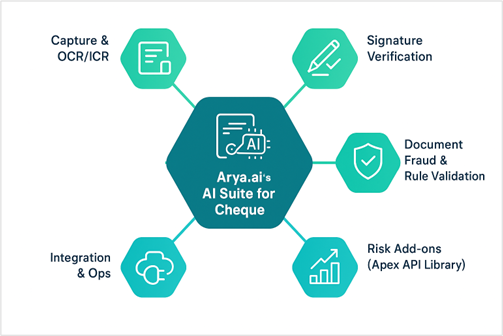

Cheque Process Automation with Arya.ai

Arya.ai offers a purpose-built AI suite for banking workflows that can help Indian banks meet the RBI’s real-time requirements. Here’s what the system looks like:

- Capture & OCR/ICR: Handwritten and printed field extraction for cheques (production-grade).

- Signature detection & verification: Dedicated API with signature localisation, extraction, and verification, plus confidence scores to shrink manual reviews and document fraud.

- Document fraud & rule validation: “Business rule validation” at the field level and image checks to stop altered or incomplete items early.

- Risk add-ons from Arya Apex API library (when relevant to bank workflows): Bank statement analysis to enrich risk signals; liveness/face/ID verification models also available for remote-deposit contexts

- Integration & Ops: The system ensures ultra-low-latency, plug-and-play, with no data storage —useful for embedding into core banking and clearing interfaces.

Conclusion

RBI’s new cheque processing rules mark a transformative shift in payments clearing. They not only set ambitious turnaround times for cheque clearance but also implicitly push banks toward greater digitization and efficiency. The impact will be felt across operational, risk, and customer service dimensions of banking.

However, with strategic investments in real-time automation, banks can turn this mandate into an opportunity. Faster, automated cheque processing will mean better compliance, reduced fraud, happier customers, and leaner operations.

In the broader picture, it modernizes a century-old payment instrument (the paper cheque) for the 21st century, ensuring that it remains relevant and reliable in an era dominated by instant electronic transactions.

As RBI’s initiative rolls out in phases through 2025 and 2026, the banks that leverage technology and prepare early will set themselves apart as leaders in innovation and trust. If you want to lead the charge in automating cheque processing, connect with our team today!