Q4 & FY25 Financial Results & Business Updates

Mumbai, May 13th, 2025

Aurionpro Solutions Limited (BSE: 532668) (NSE: AURIONPRO), announced its audited financial results for the fourth quarter and year ended 31st March, 2025.

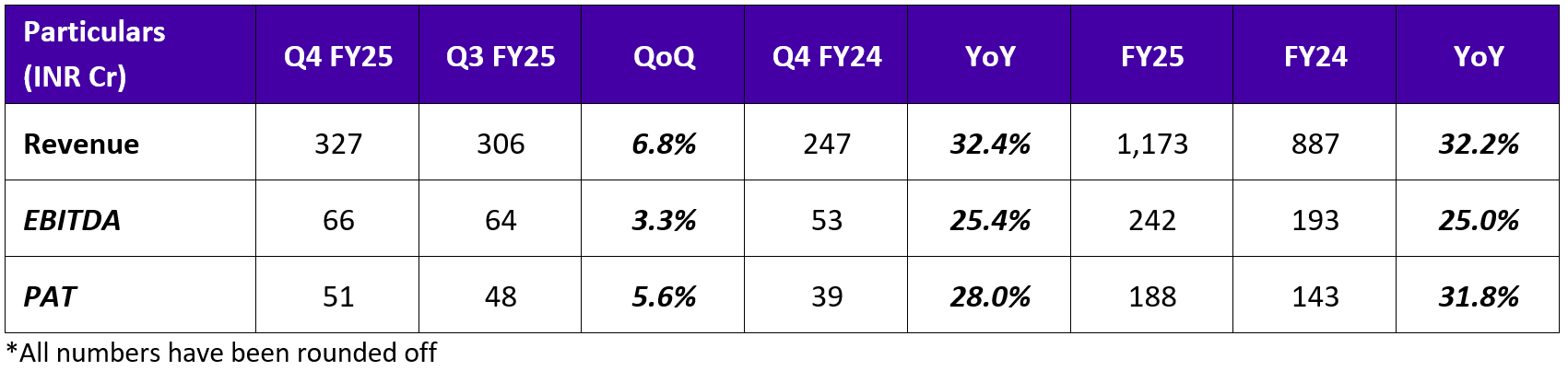

Financial Highlights:

Results Highlights:

FY25

- Revenue from operations witnessed a strong growth of 32.2% in FY25, reaching Rs. 1,173 Cr as compared to Rs. 887 Cr in FY24

- Banking and Fintech segment reported a growth of 33.7%, amounting to Rs.631 cr in FY25

- Technology Innovation Group reported a growth of 30.4%, amounting to Rs. 542 cr in FY 25

- BITDA and PAT margins for FY25 stood at 20.61% and 16.06% respectively

-

-

Q4 FY25

- Revenue for the quarter stood at Rs. 327 Cr, a growth of 32.4% on a YoY basis and 6.8% on a QoQ basis.

- EBITDA and PAT margins for the quarter stood at 20.17% and 15.45% respectively.

Management Commentary:

Mr. Ashish Rai, Group CEO said:

I am delighted to present full year results for what was a truly path breaking year for Aurionpro. Both our businesses delivered yet another year of industry leading performance, making this the fourth consecutive year of 30%+ growth, a fairly rare feat in our industry. This sustained trajectory reflects the global relevance and competitiveness of our strategic framework, increasing differentiation of our IP-led products from the rest of the industry and the deep trust of our customers that can only be earned through consistent, focused effort from our teams across the world in making every Aurionpro client successful.

This year’s strong performance is in line with our guidance. We achieved revenues of INR 1,173 crore, a growth of 32% year-on-year. EBITDA and PAT grew by 25% and 32% respectively, driven by strong execution, operational discipline, and a continued focus on value creation. Our financial foundation remains solid, with a strong balance sheet, healthy financial ratios, and strong cash flows.

We added 42 new logos in the year and now over 350 customers across the globe trust us with their technology and digital transformation journeys. We have been enormously lucky in attracting some of the best talent in the industry and with a world-class team of more than 2,700 professionals, I am confident that we will continue to drive industry leading innovation and client success across geographies and business verticals.

We continued to execute this year on several other aspects of our strategic blueprint, that are crucial to our long-term trajectory. We commenced the year with a successful fundraise, backed by like-minded and marquee institutional investors—a strong endorsement of our vision and strategic playbook. We continued to deploy capital to selective inorganic opportunities where we felt we had the opportunity to create exceptional return for our shareholders by acquiring product businesses run by high quality, high integrity management teams that fit well with our overall blueprint.

The two high impact acquisitions we completed during the year will play a significant role in our execution in FY26 and beyond. Our acquisition of Arya.ai has added industry leading enterprise AI capabilities to our portfolio, enabling us to support banks and insurers in driving complex AI-led transformation and decision-making at scale. The acquisition of Fenixys has not only strengthened our capital markets practice but also made a dramatic difference in our ability to deliver to large banks in Europe, a key strategic focus for us over the next few years. Both the acquisitions point to how strongly our unique culture and long-term strategy resonates with high quality management teams that want to make a global impact. As we continue our march to Vision 2030, I am confident we will continue to be a magnet for strong technology businesses that want to leverage our unique strengths to amplify their impact and create significant value for our respective shareholders.

Our business momentum remains strong as we enter the new financial year, our orderbook is at record levels of 1400+ crores, and both our segments are entering the year with a healthy and growing pipeline. As such, our overall FY26 outlook for both the segments remains very positive. We will significantly step up our investments in FY26 specifically in 3 areas, building out a mature sales and delivery capability in Europe, investing in product buildouts to address new markets as well as adjacencies and increasing our investments in Enterprise AI and evolving to an AI-native Application stack across the board to capitalise on the enormous value creation opportunity in front of us.

I feel we are well placed to continue our high growth trajectory over the short to medium term and for FY26 we expect to continue to grow north of 30% as we have done over the last 4 years. Thanks to the tremendous effort and focus from our teams over the last few years, many of our products are firmly on the path to becoming industry leaders in their domain. We have progressively established superiority in our home markets in Asia for our key offerings and our focus over the next few years will be on amplifying our reach and impact by pushing ahead into Europe and Americas to deliver our vision 2030 ambitions.

About Aurionpro Solutions Limited

Aurionpro Solutions Limited (NSE: AURIONPRO) (BSE: 532668) is a global leader in providing advanced technology solutions with a focus on Banking, Mobility, Payments, Insurance, Data Center Services, and Government sectors. We leverage Enterprise AI to create comprehensive solutions that drive intelligent transformation for our clients worldwide. Our team of over 2,700 professionals brings a global mindset and deep domain expertise to deliver tailored services that empower our diverse clientele to achieve their strategic goals. For more information, visit www.aurionpro.com

For further information, please contact:

Adfactors PR Ltd

Aashvi Shah

Tel No: 9821043389

Email: aashvi.shah@adfactorspr.com

Aurionpro Solutions Ltd

Mr. Ninad Kelkar

Email: investor@aurionpro.com

www.aurionpro.com